michigan gas tax rate

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. What is Michigans gas tax now.

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon.

. Call center services are available from 800am to 445PM Monday Friday. Major factors that can be measured by MGU are summarized in the lower left-hand corner of your monthly bill. For general questions please email TreasMotFuelmichigangov.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. 66 of gross cash market value. Gasoline Tax established at 2 cents per gallon.

Prepaid Diesel Sales Tax Rate Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon. But she opposes changes to Michigans gas tax. The tax rate was last changed in 1997 when the rate was increased from 15 cents per gallon to the current 19-cent per gallon rate.

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. 2 Includes reservation charge. Repealed 1947 PA 319.

The motor fuel tax on gasoline is expected to generate over 839 million for. That includes a roughly 1. The Michigan gasoline tax 263 cents per gallon.

2630 cents per gallon of regular gasoline and diesel. 2022 Michigan state sales tax. Sales tax exemption Sales and use tax exemptions for energy used by some nonprofit and governmental organizations agricultural producers industrial processors and businesses with residential electric use.

Added Chapter 3 Liquefied Petroleum Gas Tax to 150 PA 1927 at 45 cents per gallon. Counties and cities are not allowed to collect local sales taxes. Effective for the period October 1 2021 through October 31 2021 the prepaid sales tax rates for the purchase or receipt of gasoline and diesel fuel are.

These tax rates are based on. This tax is established in the Motor Fuel Tax Act 2000 PA 403. Prepaid Gasoline Sales Tax Rate Effective April 1 2022 the new prepaid gasoline sales tax rate is 176 cents per gallon.

This rate will remain in effect through April 30 2022. The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6. Information on natural gas service and rates for residential customers in Michigan.

Gretchen Whitmer wants Congress to slash the federal gas tax and supports rolling back the states 6 sales tax on gas. For fuel purchased January 1 2017 and through December 31 2021. In 2012 Michigans statewide flat tax rate fell from 435 to 425 although the city income taxes levied by 24 Michigan cities including Detroit were untouched.

1 Includes all surcharges for residential residence. Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. In addition to these two taxes Michigan also imposes a 78-cent-per-gallon environmental fee on gasoline and diesel.

This rate will remain in effect through April 30 2022. Diesel Fuel Tax established at 5 cents per gallon. Several factors can influence your businesss monthly gas use.

Gasoline 263 per gallon. It will remain in place until at least the end of the year. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

As shown in Figure 3 during 2018 the price for gasoline in Michigan averaged 2746 per gallon implying that 1459 represented the price. The state fuel tax is levied in addition to the federal gas tax which has remained at 184 cents per gallon since 1993. Gas Natural Gas Liquids Condensate.

Michigan Gas Choice Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. Diesel Fuel 263 per gallon. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST.

Alternative Fuel which includes LPG 263 per gallon. Compressed Natural Gas CNG 0184 per gallon. 5 of gross cash market value.

Also in addition to these state taxes and fees the federal government imposes taxes on motor fuels 184 cents per gallon on gasoline and 244 cents per gallon on diesel motor fuel. Increased Gas Tax rate to 45 cents per gallon. Gasoline 272 per gallon.

State Senate Democrats. MGU rate book Natural gas prices as filed with the Michigan Public Service Commission. But both Republicans and lawmakers from her own party balked at the proposal which would have almost tripled Michigan s gas tax giving the state the highest gas taxes in the nation.

For fuel purchased January 1 2022 and after. Groceries and prescription drugs are exempt from the Michigan sales tax. How a rate review works Learn about the rate review process.

Exact tax amount may vary for different items. 4 of gross cash market value. Highway Trust Fund for infrastructure spending.

Repealed 2 PA 1925. The same three taxes are included in the retail price on diesel although the Federal diesel fuel tax rate is 244 cents per gallon. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers.

52 rows The current federal motor fuel tax rates are. MiMATS users should continue to use the MiMATS eServices portal. Increased tax rate to 3 cents per gallon.

COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. 168 cents per gallon. 171 cents per gallon.

As of January of this year the average price of a gallon of gasoline in Michigan was 237. Diesel Fuel 272 per gallon. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent.

The Great Lakes State has made a number of changes to its tax code in recent years.

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

Fiat Chrysler To Put 1 Billion Into U S Jobs And Revive Jeep Wagoneer Chrysler Fiat Michigan

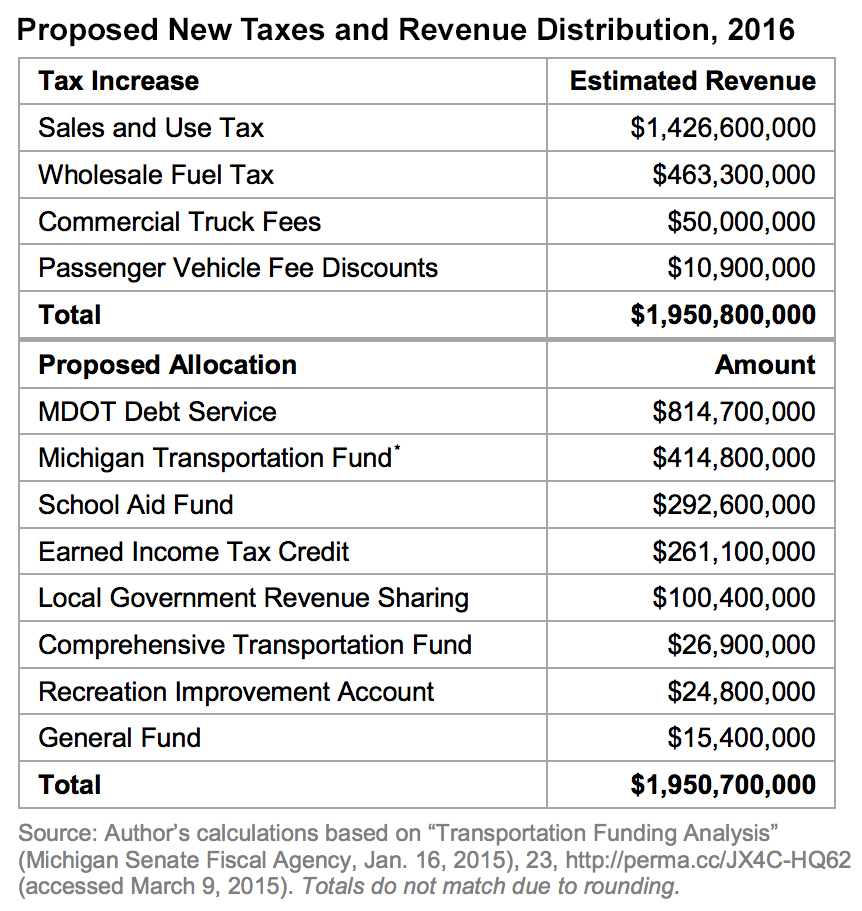

Michigan S May Tax Proposal Mackinac Center

Michigan S Gas Tax How Much Is On A Gallon Of Gas

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

U S States With Highest Gas Tax 2022 Statista

Michigan Gas Tax Calculator Michigan Petroleum Association

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan House Leaders Pass Bill For 6 Month Pause In 27 Cent Per Gallon Gas Tax

Whitmer Vetoes Bill Suspending Michigan S 27 Cent Per Gallon Fuel Tax

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy